On FIRE

Thoughts on a movement sweeping the generation

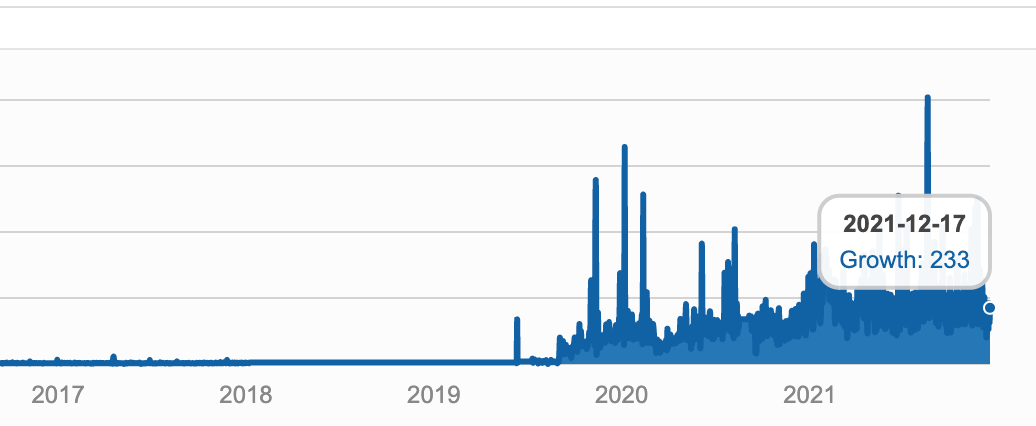

If you have been following some internet subcultures, you might have come across a term called FIRE. FIRE stands for Financial Independence Retire Early. It has gathered substantial momentum over the last two years

The general goal is to amass enough money so that you dont have to work or work for someone else. There are different dimensions in which this manifests -

High Salaries

It's a great time to graduate as a software engineer in India. The tech boom is all-encompassing, salaries are at an all-time high, raises are in multiples not percentages, people are scrambling to find good engineers1.

Lets say you started at a good package, within one year you move up by 40-50%. It's not enough to you, since your one friend is earning even more in an algorithmic hedge fund or FAANG. So you move again.

The problem with this entire path, is that you will always be dissatisfied. Someone will always be earning more than you, and you will try to close that gap like chasing a golden deer (I hope Ramayana references are not lost in this generation). The thing with dissatisfaction as a feeling is that it blocks us from seeing the lotuses among the muck. It's like a pessimist looking at a glass and always yearning for more water. So you develop a mindset of always taking.

The one thing that has been eternally true in any sort of work is that it's about give and take. It's never one-sided. However, this mindset of always taking makes you feel that your organisation owes you more and more. Initially, you might feel that you are slogging 10 hours a day, so the org should be paying you more. Later you'd feel the same way about 8, 6 etc. If you abstract it out, it also keeps moving your goal post. E.g. Let’s say you start with a goal of 1 cr. for your financial independence, soon it will move to 3, then 6 etc. As your lifestyle and aspirations also adjust.

High salaries are a great way to build risk cushion in life. If you are doing great work, you should also be compensated fairly. But do know that the customer contribution comes first, because the business exists to serve its customers. I'd posit that most people also feel more satisfied if they get the feeling of contribution. To that extent, betting on esops on the right company has a better likelihood of achieving financial independence, while also working with the feeling of ownership2.

Investments

With internet democratising information and low interest rates, the number of people entering into stock markets has exploded.

People are entering into day trading, taking stock tips from influencers and playing the equities game. I'm not Buffet to comment on how this will play out, but at the end of the day, stocks are zero-sum games. Someone has to lose for someone else to win. Overall, You should be in a position to make money grow by itself, but people who are in there just to make a quick buck without doing proper diligences might be at risk3.

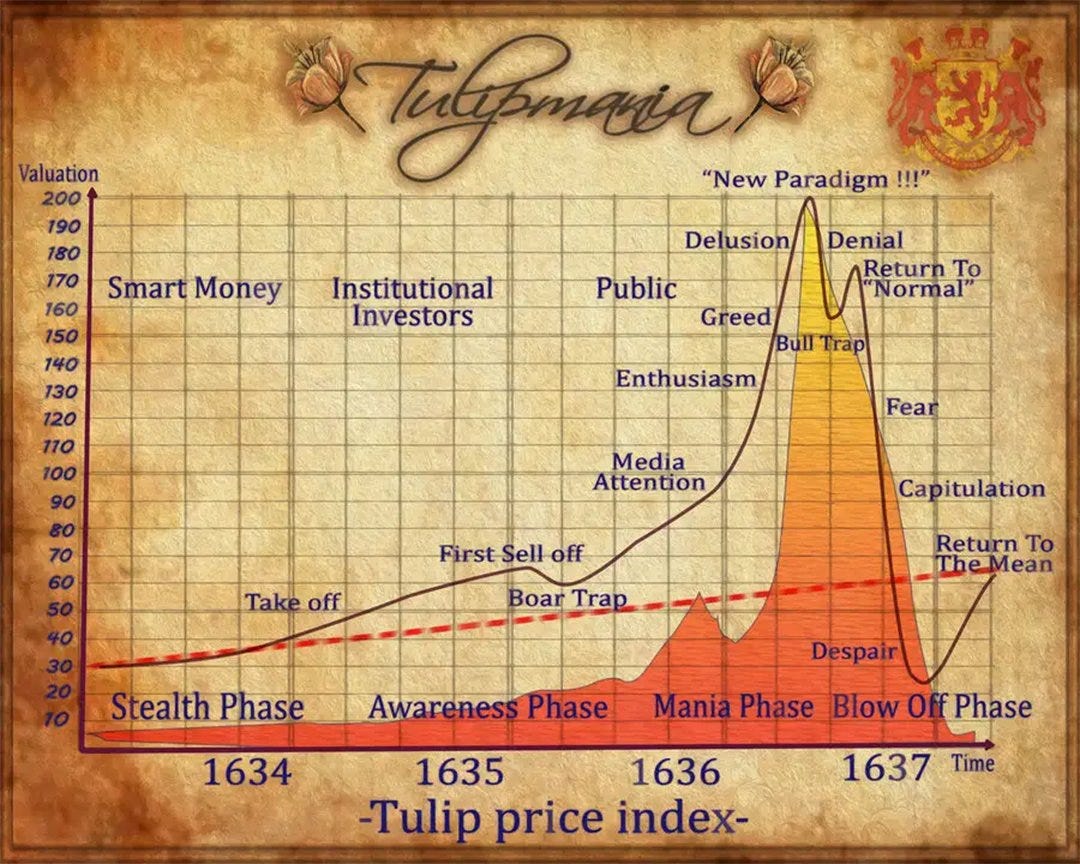

I always think about Tulip mania (when prices for tulip bulbs started reaching astronomical highs in Netherlands) when I see markets behaving weirdly. The difference though is that at least people are investing in companies that have real value and provide services, however, a lot of people seem to be relying on ‘timing the market’, which might not work for FIRE, since the goal that solves for retirement is usually much larger.

What after FIRE?

Then there's the question of what will you do after you have financial independence?

Most people would say that they would rather have a million dollars and then think about the problem. But it's not as simple. Once you have enough choices, you also aren't unable to choose. Plus some of the romanticism we have (e.g. I'll be a musician) might break when we actually come to it (e.g. we might realise we dont actually want to make music daily, it was okay as a weekend thing).

This is where the creator/passion economy comes in. A lot of people are trying to make themselves known through their passions on the side, be it cooking, writing, music etc. Some people are doing it part-time, ready to take a full risk when they get good traction. Some are already in it full-time and grinding to make their spot. In general, it's a great way to be working on things that you like and potentially earn income/fame from it. If it clicks, you do solve the money problem once and for all, but it's not an easy path at all. And expectations have to be calibrated accordingly.

So a lot of the trends that we see tie back to FIRE.

The person who is job hopping constantly to get salary raises wants FIRE.

The person who is making stock bets based on Telegram channels also wants FIRE.

The person who is starting a venture also probably wants FIRE.

The person who left his job to become a full-time Youtuber also probably eventually wants FIRE.

The great privilege that our generation has over the last one is the leverage that is created through code and internet, fuelling our ambitions to think about earning wealth and retiring faster. I fundamentally believe everyone should be able to work on whatever they want to and get valued for it. The only caveat is, give before you take.

This phenomenon is more in tech jobs - engineers, data scientists, PMs etc as software is eating the world.

ESOPs are riskier than Salary, so the probabilistically safer path is to play the salary game.

I understand this is a blanket statement, however it does seem weird to think that everyone will make money here. Open to opinions on this.