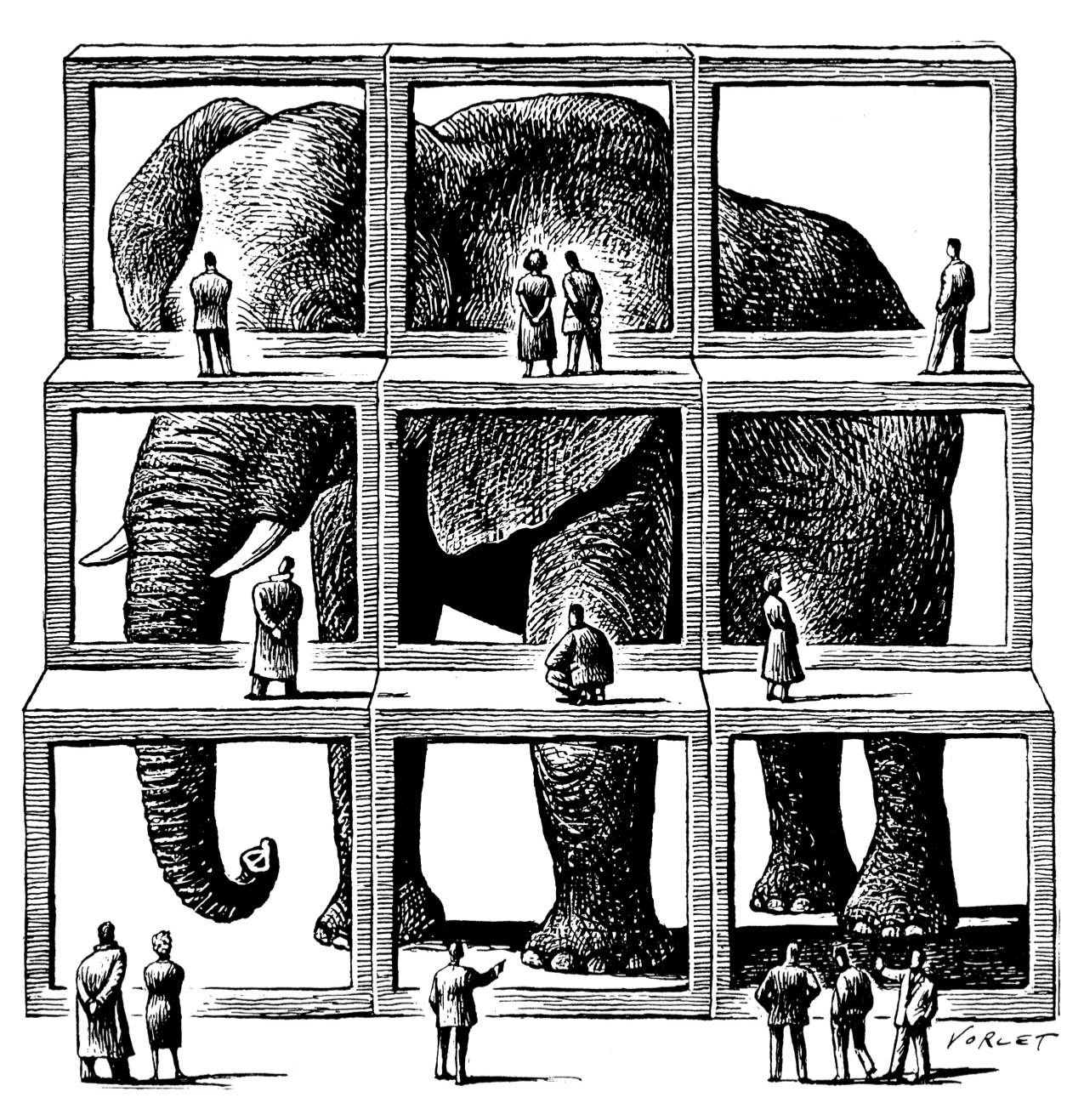

Context matters

On succession as Twitter changes guard

When I was in consulting, I often used to complain of just copy-pasting stuff that others were doing. I often thought 80% of the idea was already out there, all we did was contextualisation in the rest 20%. I later realise that there were multiple flaws in that thinking -

While innovation can be disruptive and game-changing, it's also okay to look at other people for inspiration.

When you do borrow from outside, keep the copying to 20% and contextualisation to 80%.

What is context?

Context comes in various forms in business.

Industry context —> how is the market evolving? Is it growing or declining?

Company context —> what is the company strategy? Strengths and weaknesses?

Organisation context —> how is the culture? Adaptability, competence etc? Employee engagement?

Stakeholder context —> how satisfied are the customers? Investors?

Why context matters?

Companies are path-dependent. A company usually makes a set of choices early to make its own space in the market. These choices are across different fronts - what products to build, how to reach out to customers (Refer this article for the tussle between the two), what kind of people to hire etc. Based on this, at any given stage, company is like an organism, whose some faculties are well-built and some are underdeveloped.

Your goal is to keep feeding the organism with customers and revenue, while investing in developing capabilities to maintain the growing size. To do this well, you have to accurately assess which functions are doing well, which are not.

A lot of people from outside are unable to do this well. Mainly because of multiple reasons

They do not spend enough time unlearning previous contexts and then learning new contexts

If it's a public market company, there is usually a pressure to deliver results quickly. Which often manifests in taking decisions without understanding the full nature of the organisation. Public market also leads to some extra risk aversion for some leaders.

Executive pay structure, if indexed higher on salary, creates a principal-agent problem. There's no incentive to think long-term

This is why companies with founder CEOs usually outperform others. Founder CEOs have the most context and the highest skin in the game.

Founder > Founding Team > Internal Leaders > External Leaders

When this fails?

There are of course situations when this does not hold true.

One such situation is when the nature of disruption in an industry is such that truly self-disrupting thinking is required, which is harder to do for people who are too close to the problem. Even then, people with context are more likely to drive through these transitions better.

E.g. Intel deciding to shift focus from memory business which was 95% of its revenue at the time and focus on microprocessors instead. Slack spinning out of a fledgling gaming company.

This also fails when even as founder or people with context, you don't scale well with the org and change your leadership and role accordingly.

That said, there are examples of outside leaders coming in and making companies successful1 - Frank Sootman for Snowflake, Lee Iacocca for Chrysler, etc. But I'd posit that an internally grown person, who is also aware of the macro context, has a higher probability of doing a better job ceteris paribus.

P.S. Congratulations and all the best to Parag Agrawal (IITB 🤘🏼 ). Not going to be easy being at the helm of one of the most important media companies in the world.

It’s very hard to define success here. E.g. Jack Welsh’s touted to be among the greatest CEOs but a lot of his decisions (particularly GE Finance) turned out to be massive mistakes after his tenure. In Snowflake’s case, the company grew by multiples during his tenure, but could be argued that it was due to being early in the market. Failure might be easier to attribute though. E.g. John Sculley was clearly unsuccessful at Apple.