Edtech in India: From Banyan Tree to BYJU and beyond

What the latest acquisition means for the booming edtech space

Welcome to the 35 new subscribers last week. More insights into the Indian business ecosystem shall keep coming! On this Independence day, we dive into the heart of (middle class) India’s favorite obsession – education industry.

This month, BYJU’s acquired White Hat Jr. in what seems to be the fastest exit in Indian ecosystem – 300 mn $ exit in under 2 years of inception. How did this happen? And more importantly, what does this mean for the edtech space in India?

From banyan tree…

Eons ago, students used to sit together in the grass while their guru used to impart wisdom, sitting under a banyan tree. The education was more about having a good way of life and enlightenment.

Image credits - Indusscrolls

Slowly, then education became more utilitarian, to impart skills required in a job. The earliest example of this was different education based on different castes, since different castes meant different work in ancient India. The utilitarian nature of education has persisted since then, as even schools prepare students for future jobs, in more ways than one.

Modern education can be divided into five major segments

- K-12

- Test prep

- Higher Education (Graduate & Post-Graduate)

- Reskilling and professional courses

- Casual Learning

K-12 is the fundamental building block on understanding how the world works, delivered through schools and tuitions. Test prep is more a means to an end, of getting into specific institutes or programs (IITs, IIMs, IAS etc). Higher education bucket comprises of the learning in these institutes. Professional courses include specific courses on reskilling/certification like Six Sigma, Data Science, Agile Processes etc. Casual learning is an hobbyist’s engagement, in learning new languages etc.

K-12 is the meat of the pie. And that’s where the feast happened in India.

To BYJU…

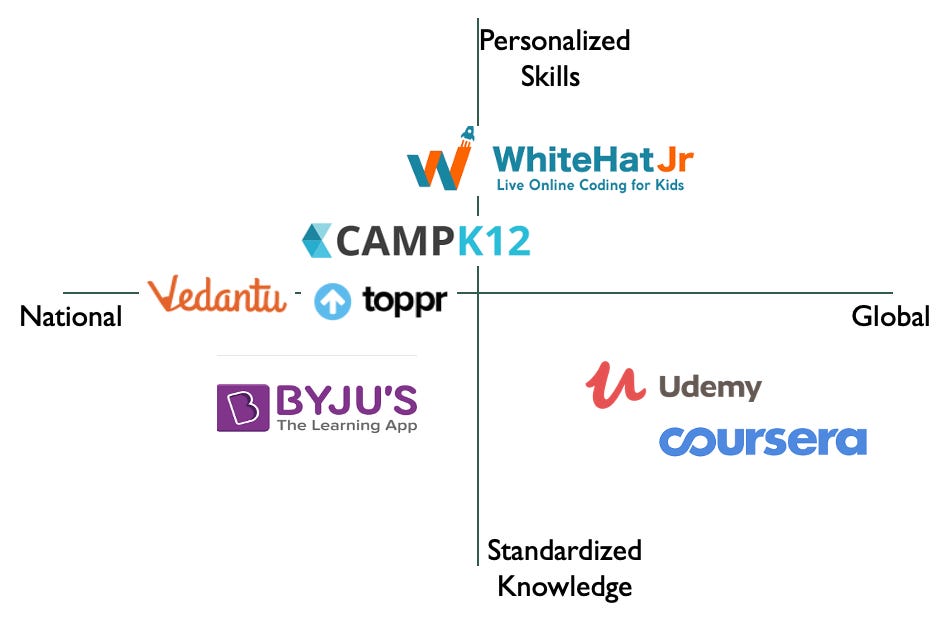

Started by Byju Raveendran, a teacher turned entrepreneur, in 2011, BYJU’s has grown to be a 10.5 Bn $ firm, 5L teachers teaching 13.5 Mn students. Byju offers video-based learning solutions to K-12 students, including solutions for test prep. Edtech firms like Vedantu started around the same time as Byju. Then Unacademy and Toppr came to the party of video-based learning, with a focus on the Test prep market.

White Hat Jr’s story begins in 2018, when Karan Bajaj starts the company to teach coding to students. It is not the first company in the space, there have been firms doing it already e.g. Camp K-12 started as a summer school for coding for students in 2010. These companies are riding on the tailwinds of the tech startup wave, which brought software and engineers in the spotlight. People started to realize coding as an essential skill for the future, not just for building software, but also for improving critical thinking and creativity.

Software is eating the world and these companies started serving dessert.

What WHJ did different however was a few things. First, it offered 1-1 classes to students instead of the norm of group online classes. This basically meant a more involved education and a premium for that. Next, it reduced the friction by offering full refund on anytime cancellation. Finally, and perhaps most importantly, it tapped into the US market. After launching US in February 2020, it’s MoM growth was 160%, faster than India and by June 2020, it had started to contribute more than 60% of its revenues. Cracking US meant that the doors were open to other mature geographies like Canada, UK, New Zealand and others.

This is where the marriage with BYJU comes in.

A player with the complete opposite strengths as BYJU would be the perfect complement for it. This gives three distinct advantages –

1. Diversify the offerings into personalized skill-based education that can be delivered online. (BYJU had already launched its coding offering but it hadn’t gathered as much response; in comparison, WHJ had 3 Mn students already)

2. Diversify into different geographies – US and then Canada, NZ

3. As a result of the above, get better customers with higher ARPUs. BYJU’s standard annual price per subject is Rs. 15000 (Grade 6 for reference). At the same time, the price of a standard app development course of WHJ is Rs 34000 in India and $ 1400 in US. This would mean a massive jump (>2x) in its revenue potential.

Hence the synergies make sense. But do the numbers? WHJ was flying at an annual run rate of $150 Mn*. At a $300 Mn valuation, that is a 2x multiple over revenue. While the service delivery is online, it is not a pure technology business, since due to the personalized nature of the classes, scaling up students wont be without the marginal costs of scaling up teachers. It has 5000 teachers, all female, in a contracted two-sided marketplace model. Below is a comparison of similar models in edtech and otherwise.

It’s odd that while compared to other edtech firms and even other two-sided marketplaces, the revenue multiple is much lower. Either WHJ fell short in bargaining or they felt this was their best chance which would be surprising with their growth rate or there’s more to the acquisition timing than meets the eye. Either way, the investors and founders made a huge exit and set a precedent for exits to larger Indian players, as opposed to the earlier options of IPO (too late) , large investor (no more Softbank) or large foreign player (How many exits like Flipkart-Walmart?).

Liked it so far? Show some love by hitting the button below

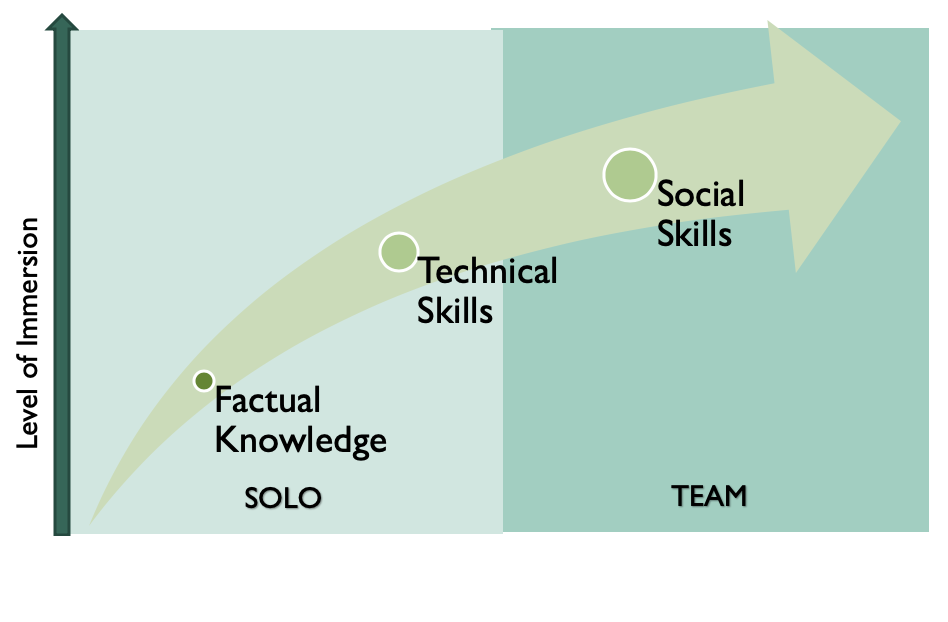

The first wave in online education was about learning by watching – Coursera, Udemy globally and Byju’s, Unacademy locally. All of them started out with one-to-many video sessions. Then learning became more immersive, by doing, through startups like Camp K-12, White Hat Jr that teach coding to student by actually making them code and Lambda School, Newton School doing the same for professionals, helping them get software engineering jobs.

What is the next trend here?

And beyond…

Unbundling education

Let’s take a step back and consider offline education media, like schools and universities. They typically have the following parts –

- Imparting knowledge (history, mathematics etc)

- Building hard skills (experimental science, hardware skills, coding etc)

- Building soft skills (collaborative projects, team sports, etc)

Online education started with the first one and WHJ epitomizes the second one. The second trend has just touched coding so far, it will touch anything that involves individual creation using a laptop – design, writing etc. Hence, it wont be a surprise if we see 1-1 classes being conducted for graphic/animation/product design, literature, writing, etc. However, the growth wont stop there.

The next wave will imbibe social factor into online education.

This could happen through multiple approaches

- Existing startups building a social layer into their learning. Reducing online class sizes to <30 and then having virtual classes and projects to do online. Due to COVID, current schools are doing the same using Zoom or Microsoft. However, this is unlikely to continue long-term. Traditionally online firms, with the DNA to disrupt, will have an advantage here. This is already happening in startups like Camp K-12 who teach coding to a limited set of students per session.

- An inorganic way of executing this online is by way of partnerships between edtech firms and dating/friendship firms like Bumble or Tinder.

- Small offline groups are a great way to form strong interpersonal connects (which is the reason the school & tuition system thrives). Online firms could actually look at establishing offline centres for conducting limited peer-learning activities, just like a lot of e-commerce firms went offline for certain core experiences (Livspace, Lenskart).

Of the $100 Bn education market in India, online education is still < $1.5 Bn. There’s a long way to go and online can learn a lot by unbundling traditional education and offering those in its own unique way.

Going Global

WHJ is not the only Indian edtech firm successful in other mature country. Camp K-12 also has a user base in US, Spain and Indonesia. Quizizz, a startup of India, has its customer base (50+ Mn MAU) entirely in US.

There are reasons going international makes sense

1. Charging US rates with an Indian cost structure is one of the best arbitrages to exist and IT & SaaS companies (Infosys, Wipro, Freshdesk) have been exploiting it since quite long.

2. Mature economies provide a much more educated (literacy rate 85%+ because of higher spend on education by govt), open and high revenue potential customer base.

3. India still has much deeper problems to solve in education. Only 66% females are literate in India compared to 82% in the world overall. Even that education quality is questionable, especially in the rural areas. It will take some time before a young girl in a rural town in India could learn app development on her laptop with high speed internet.

Going global surpasses these problems and provides a platform for Indian startups to deliver and extract higher value. With time, the revenue coming from international economies can be used to subsidize education for the underprivileged mass of the country. That will be the true edtech growth story in India.

P.S.

*WHJ offers full refund for any time cancellation. This revenue risk should be provisioned in this number.

If you liked this article, hit the green button below to get these delivered directly in your inbox.

Please leave your feedback, it is still Day 1.